National Living Wage Update 2025: What Business Owners Need to Know

National Living Wage Update 2025: What Business Owners Need to Know

As your trusted Bookkeeper, I am here to keep you up to date on the National Living Wage (NLW) and National Minimum Wage (NMW) changes coming in April 2025, as announced in the latest UK budget. Understanding these updates is key to staying compliant and budgeting for potential increases in labour costs.

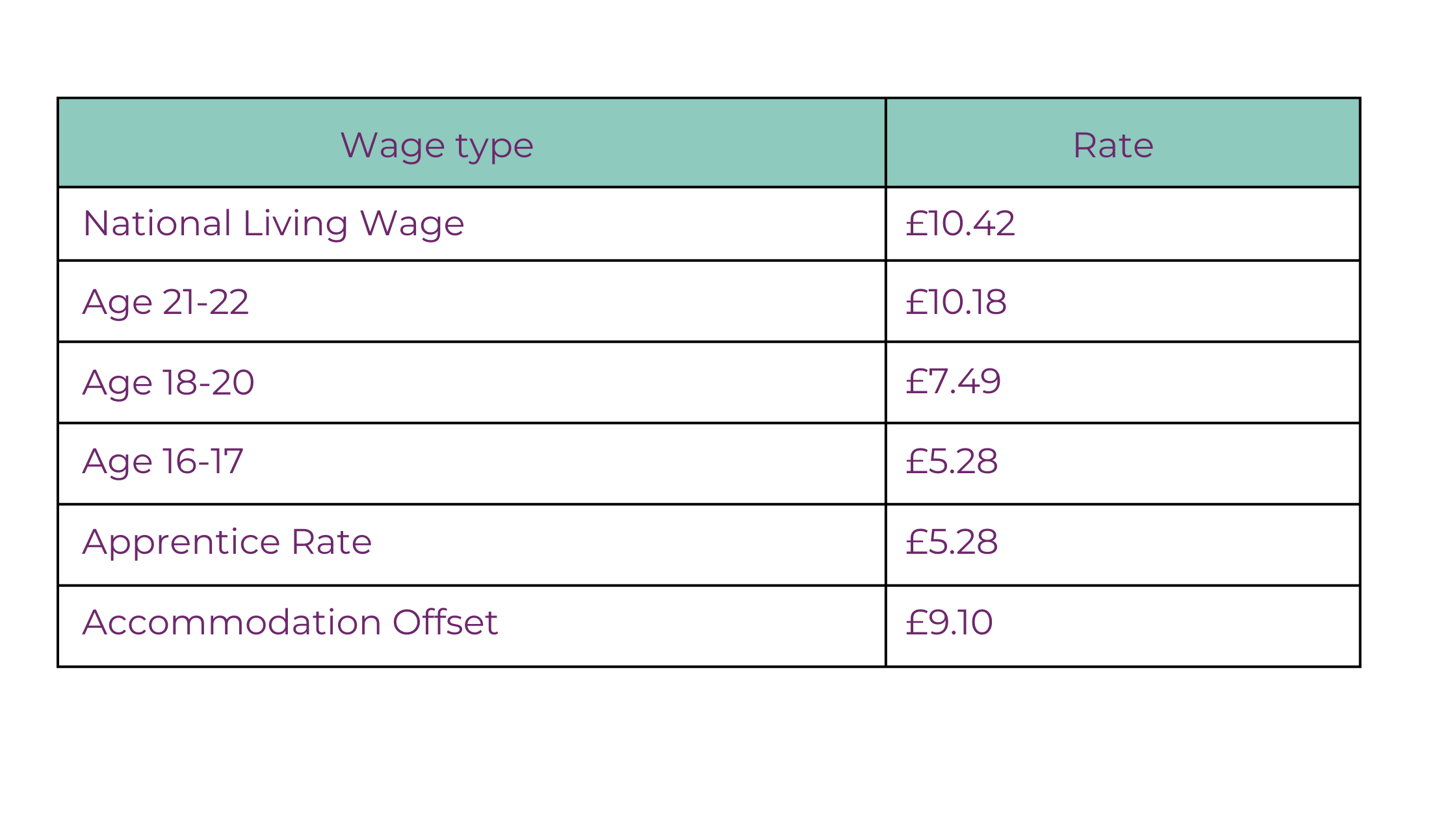

Key 2025 Wage Updates

From April 2025, the new rates will be:

- Ages 23 and over: £12.21 per hour

- Ages 21 to 22: £12.21 per hour

- Ages 18 to 20: £10.00 per hour

- Under 18 and apprentices: £7.55 per hour

These adjustments are intended to help workers manage rising living costs but will increase payroll expenses. Here is how to prepare.

Managing These Changes in Your Business

* Update Payroll Systems: Before April 2025, I will ensure that your payroll software is updated to reflect the new rates.

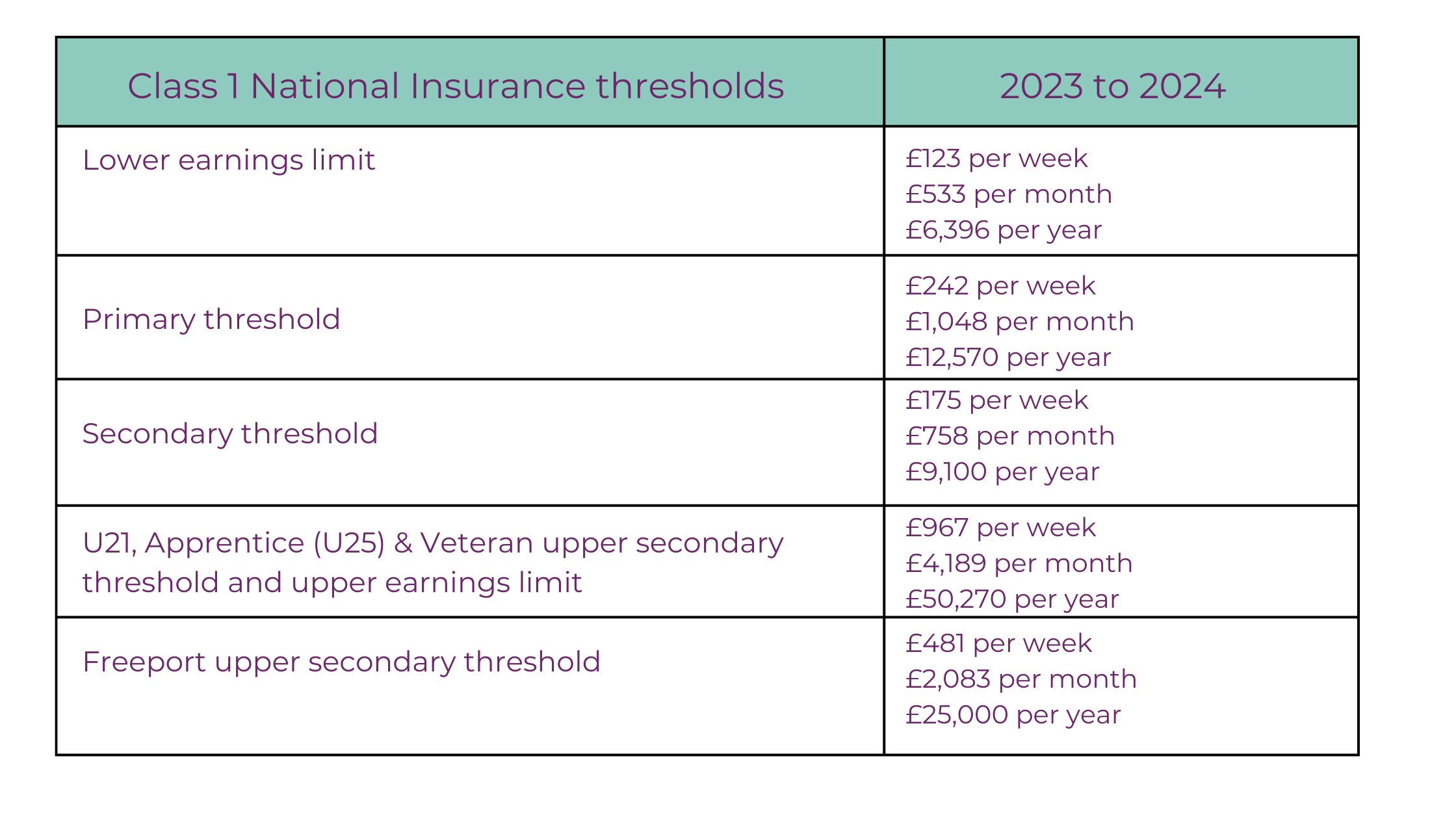

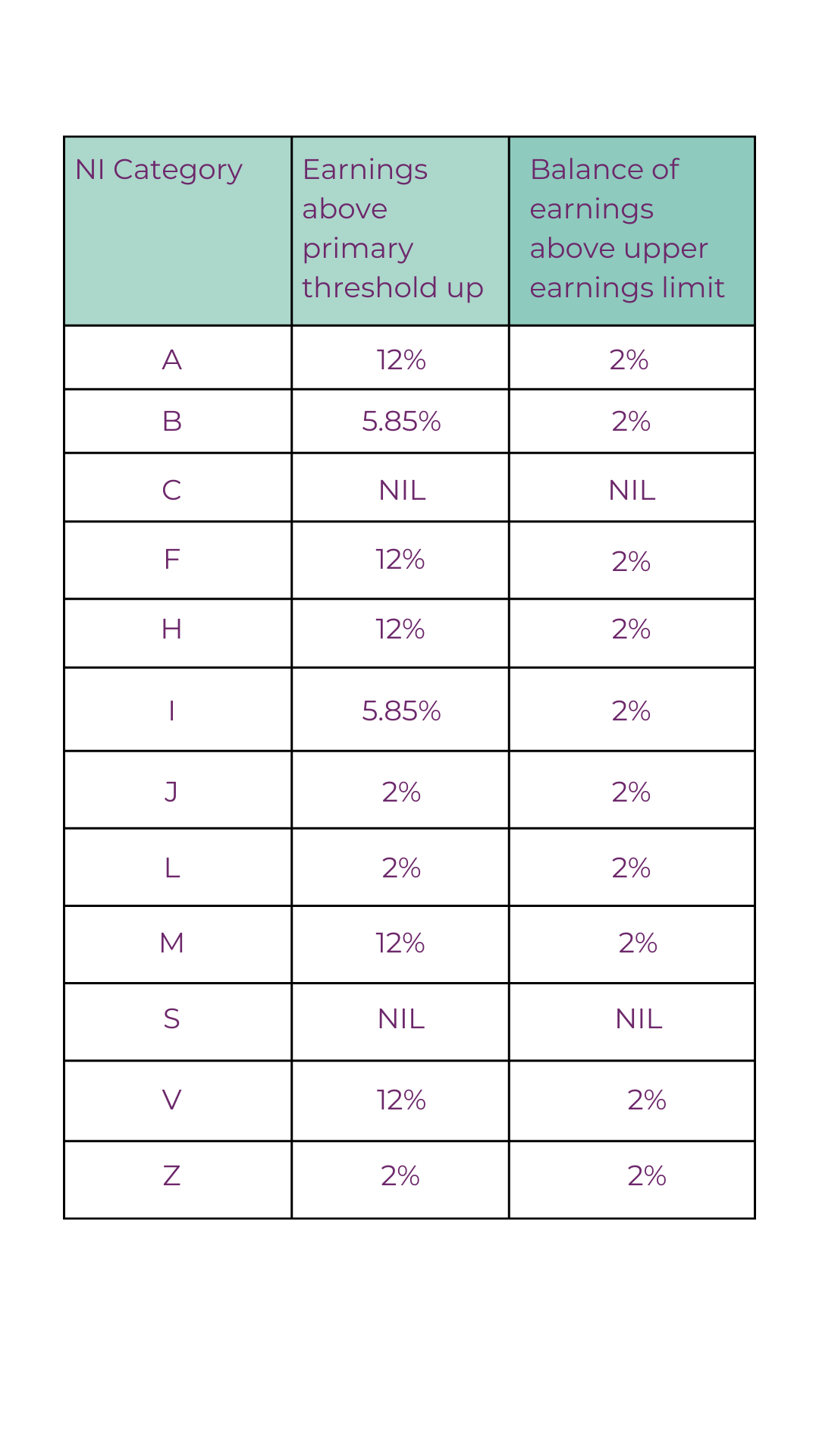

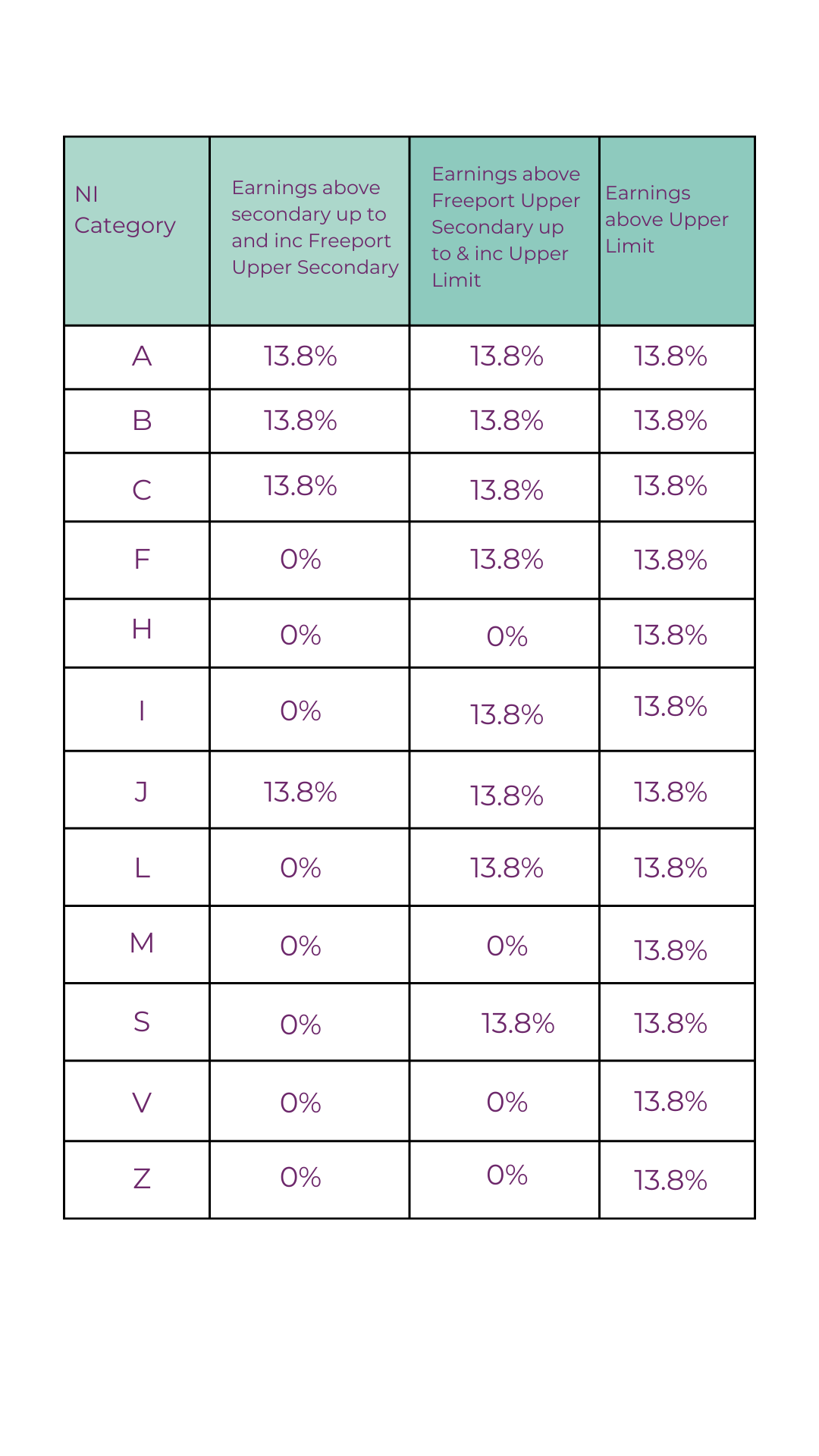

* Budget Adjustments: I will work with you to update your wage budgets, as well as calculate the impacts on your National Insurance Contributions (NICs) and pension contributions.

* Employee Communication: If you have staff directly impacted by these changes, clear communication can help them understand what to expect and shows that you are proactive about fair pay.

These changes can have a significant impact, but I am here to help you manage the transition smoothly and efficiently. Let’s start preparing early so that your business stays compliant without unexpected budget strains.

For further details, please refer to GOV.UK or feel free to reach out with any questions.

ABOUT SUE

Sue Haynes is the founder of Cactus Bookkeeping and helps business owners

with all aspects of Bookkeeping to save them time so they can concentrate on running their

business. Sue is licensed, regulated and supported by the Institute of Certified Bookkeepers (ICB)

Recent Comments