Payroll rates and thresholds for 2023-24

It can get quite overwhelming trying to keep up with all the updates when it comes to payroll rates and thresholds for your employees.

We can of course try our best to keep you in the loop with regular updates but if it does get too much as a busy business owner, you can outsource your payroll function. This way you won’t be worried about paying your staff the incorrect rates or stressing that they won’t be paid on time.

But for now here’s the latest information for you to absorb.

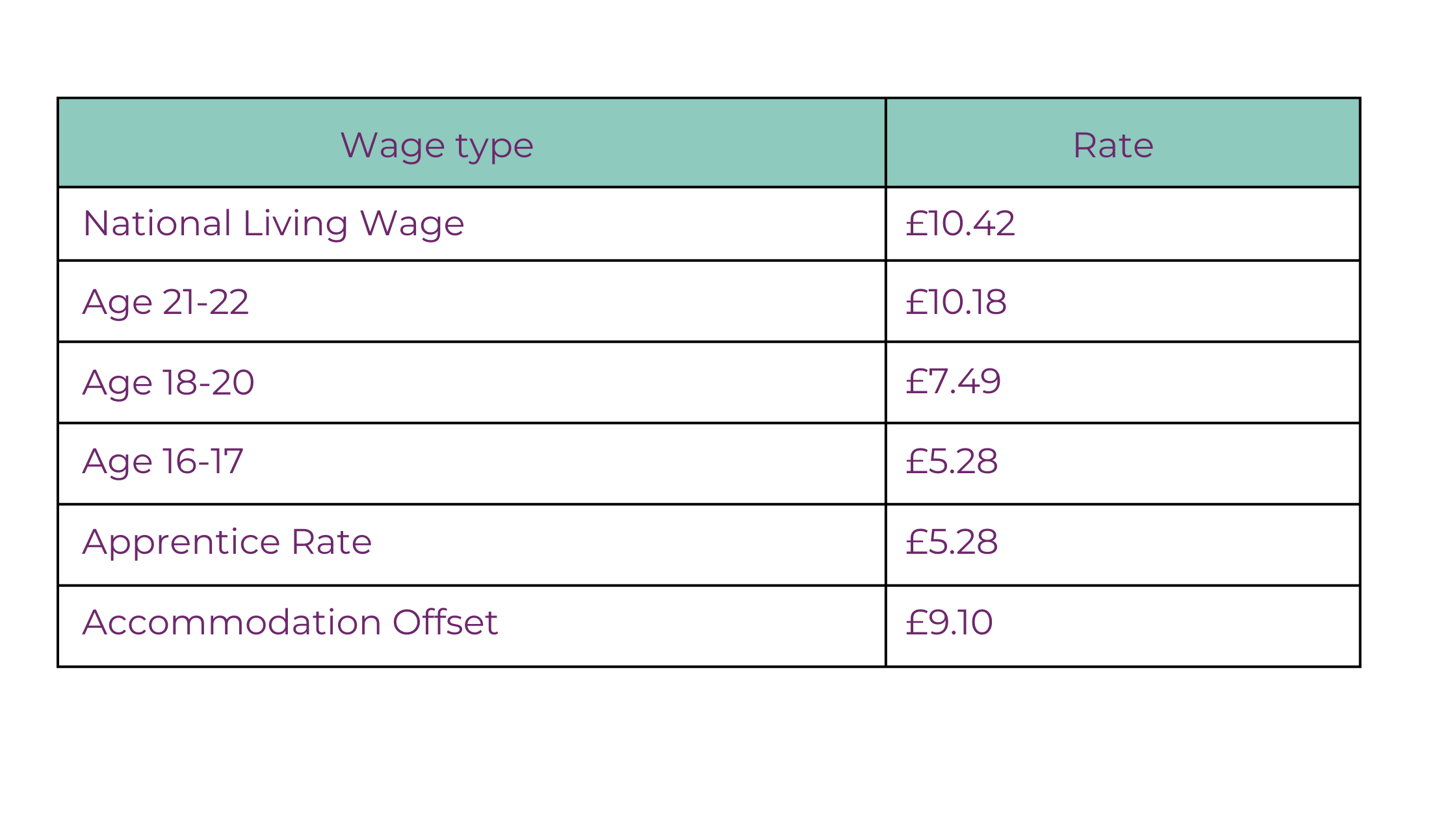

Minimum Wage

The minimum wage rate has increased for all brackets this year. Varying from a 40p to £1 increase. The following rates will be applicable from 1st April 2023.

It’s important you take note of these rates and apply them to your employees payroll from 1st April 2023.

It’s important you take note of these rates and apply them to your employees payroll from 1st April 2023.

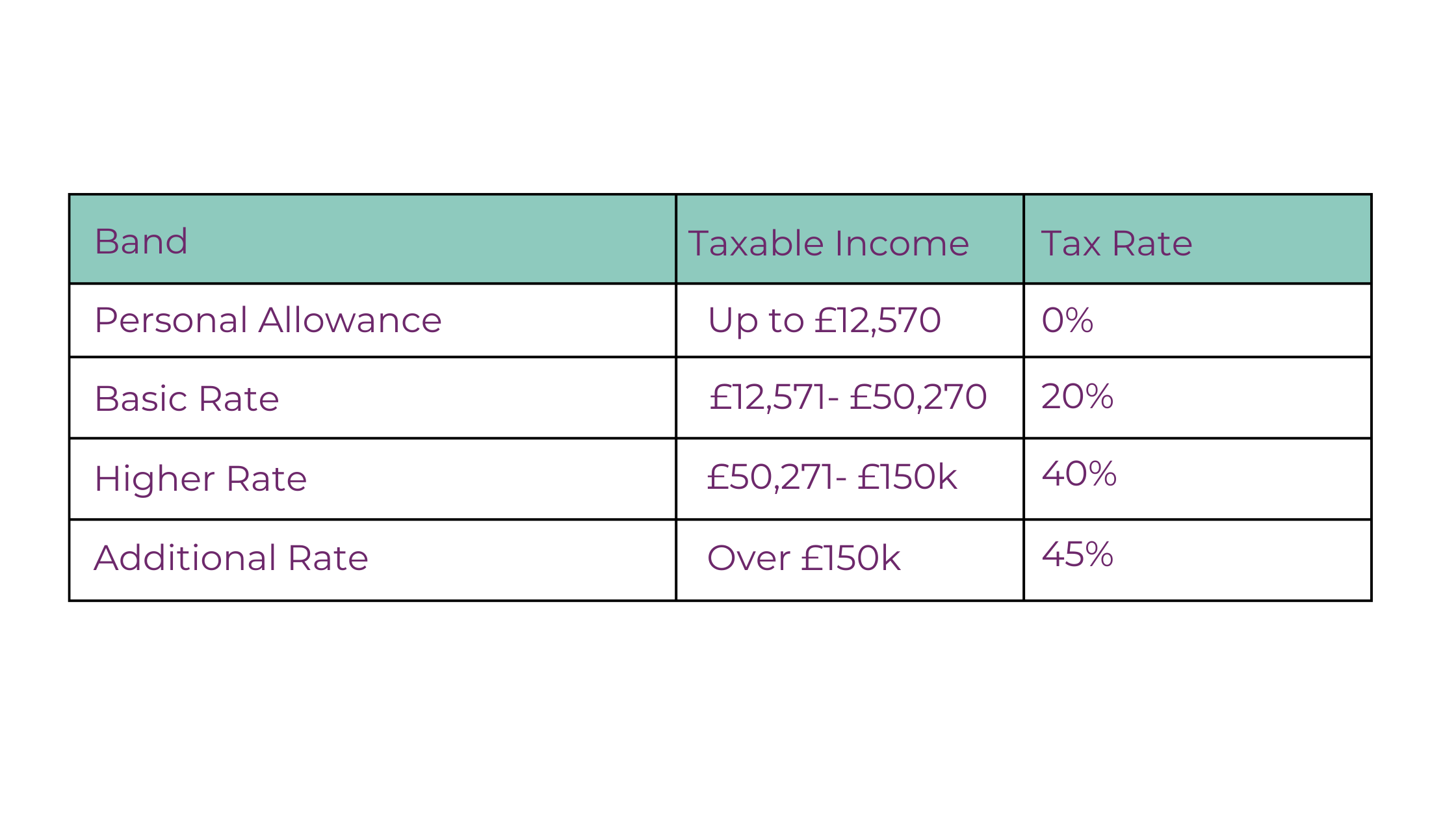

Income Tax

The amount of tax you need to deduct from your employees wages depends on how much they earn. These are the brackets set by the government along with the rates of tax that they must pay.

Emergency tax codes from April 2023 are as follows:

- 1257L W1

- 1257L M1

- 1257L X

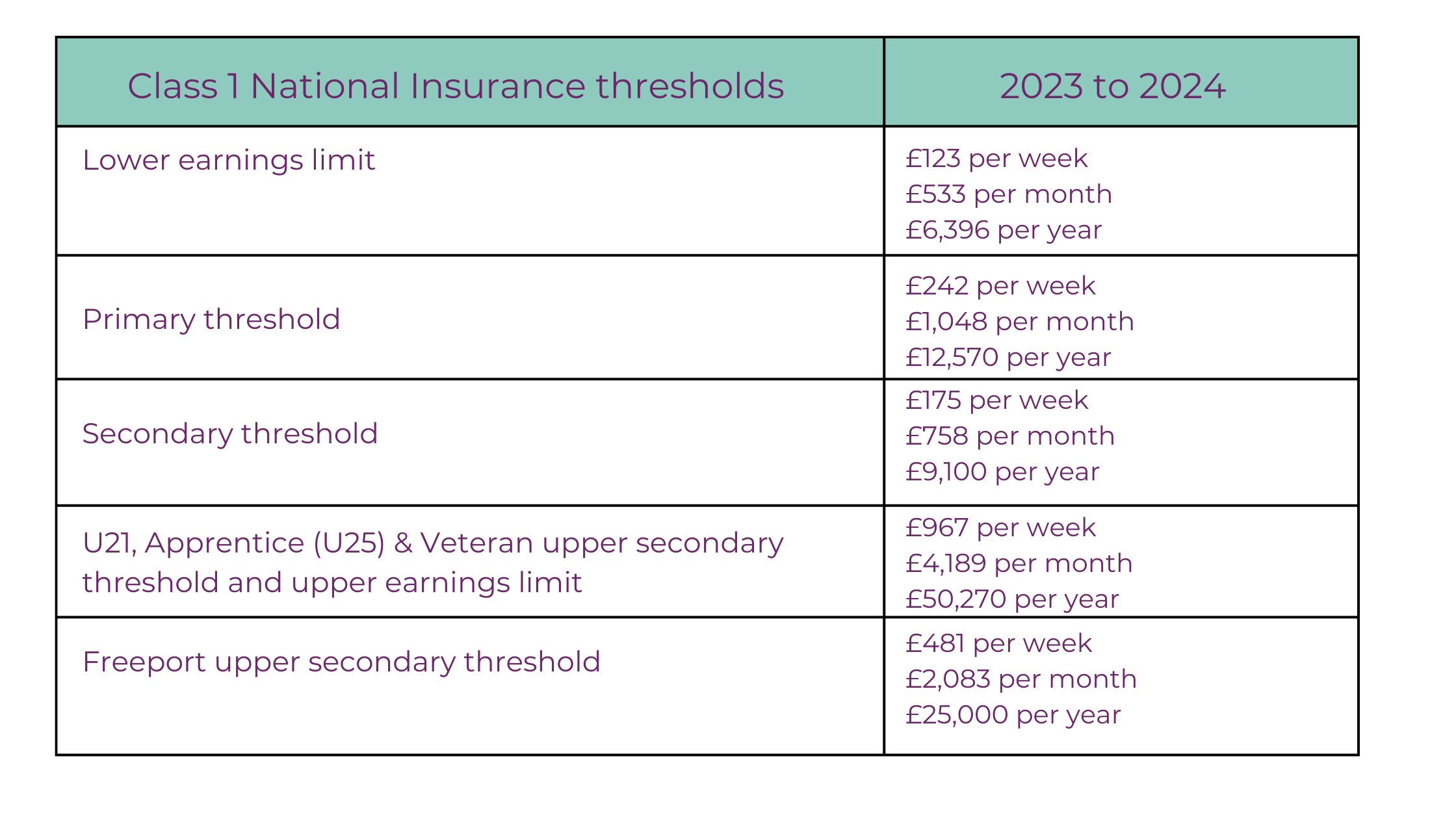

National Insurance

Here are the National Insurance thresholds from April 2023

The amount you should deduct from your employees depends on the above thresholds. If an employee is at or below the lower earning limits then no national insurance should be deducted. If they fall in any of the other categories the following rates apply form April:

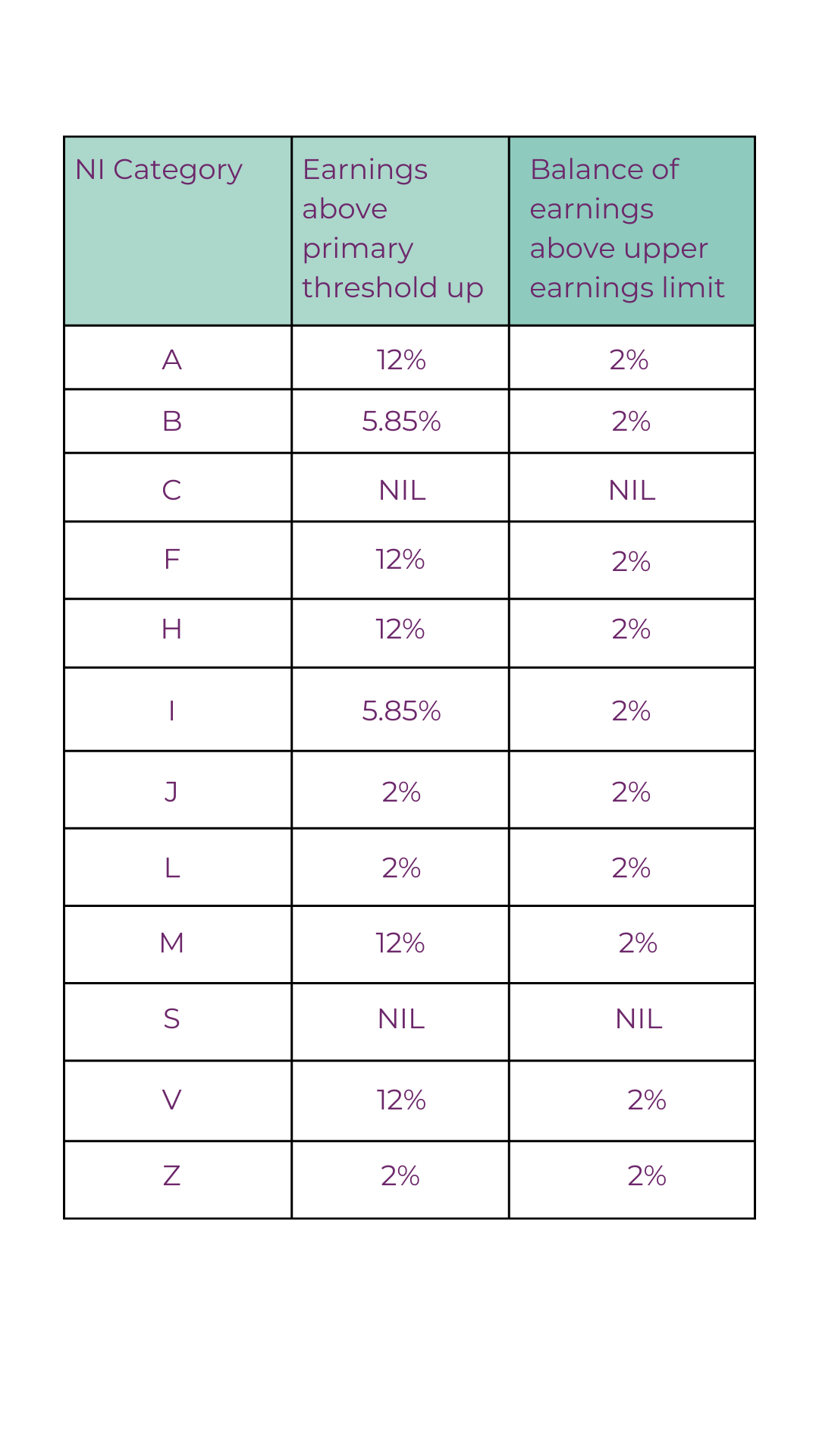

Employee Contributions

As well as remembering how much and when to pay your employees, you’ve also got to remember to pay HMRC your employer contributions.

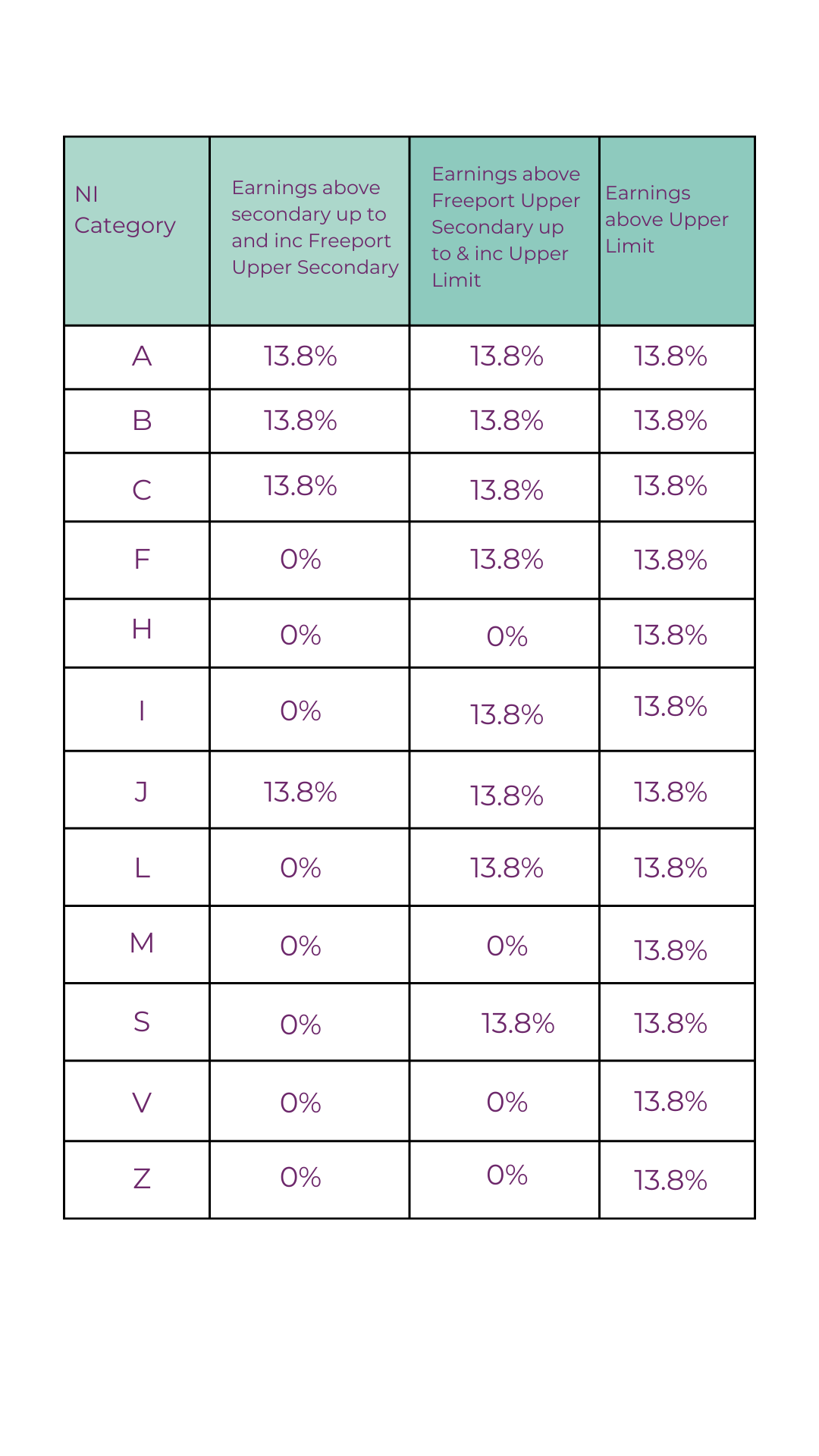

As an employer you also need to make contributions as per below, please note if an employee is at or below the lower earning limit no contributions are required.

Employer Contributions

For further information about payroll rates for 2023-2024 visit the government website – Rates and thresholds for employers 2023 to 2024 – GOV.UK.

Running your own payroll can be tricky, especially as you have to be sure you’re paying both your employees and HMRC the correct amount. If you’re worried about running payroll, why not outsource? We can take the stress away of payment deadlines and you can be sure you’re paying both your employees and HMRC correctly.

>>>find out more at https://www.cactusbookkeeping.uk or book a discovery call using the link below

ABOUT SUE

Sue Haynes is the founder of Cactus Bookkeeping and helps business owners

with all aspects of Bookkeeping to save them time so they can concentrate on running their

business. Sue is licensed, regulated and supported by the Institute of Certified Bookkeepers (ICB)